Oman, a nation rich in culture and history, is also renowned for its robust legal framework that governs employment relationships. The Oman Labour Law, promulgated by Royal Decree 35/2003 and subsequent amendments, serves as a cornerstone for regulating employment rights, obligations, and benefits in the Sultanate. This blog delves into the key aspects of Oman’s Labour Law, helping employers, employees, and stakeholders navigate its provisions.

Key Features of Oman Labour Law

- Scope and Applicability

- The Oman Labour Law applies to all employers and employees in Oman, except for specific categories such as domestic workers, armed forces personnel, and public servants, who are governed by separate regulations.

- The law emphasizes the need for written employment contracts, detailing terms and conditions of employment, to avoid ambiguities.

- Employment Contracts

- Written Requirement: Employers must provide written contracts in Arabic or bilingual versions (Arabic and English) to ensure clarity. In disputes, the Arabic version prevails.

- Content: Contracts typically include job descriptions, wages, working hours, leave entitlements, and termination terms.

- Fixed-Term vs. Indefinite Contracts: Contracts can be fixed-term (renewable) or indefinite, with termination rules varying accordingly.

- Wages and Working Hours

- Minimum Wage: Oman sets a minimum wage for Omani nationals, periodically revised based on economic conditions. There’s no mandated minimum wage for expatriates.

- Payment Terms: Wages must be paid monthly via bank transfers.

- Working Hours: Employees typically work 8 hours a day or 48 hours a week, with adjustments during Ramadan.

- Overtime: Workers are entitled to additional compensation for overtime, ranging from 25% to 100% above regular wages, depending on circumstances.

- Leave Entitlements

- Annual Leave: Employees are entitled to 30 days of paid annual leave after completing six months of service.

- Sick Leave: The law provides 10 weeks of paid sick leave per year, divided into four segments with varying payment percentages.

- Maternity Leave: Female employees are entitled to 50 days of maternity leave with full pay.

- Public Holidays: Omani Labour Law grants leave on official public holidays declared by the government.

- Termination and End-of-Service Benefits

- Termination by Employer: Employers can terminate employees with valid reasons, including misconduct or poor performance, but must adhere to notice periods.

- Resignation by Employee: Employees may resign with proper notice, as stipulated in the contract.

- End-of-Service Gratuity: Expatriate employees are entitled to gratuity upon completing at least one year of service, calculated as 15 days’ wages for the first three years and 30 days’ wages for subsequent years.

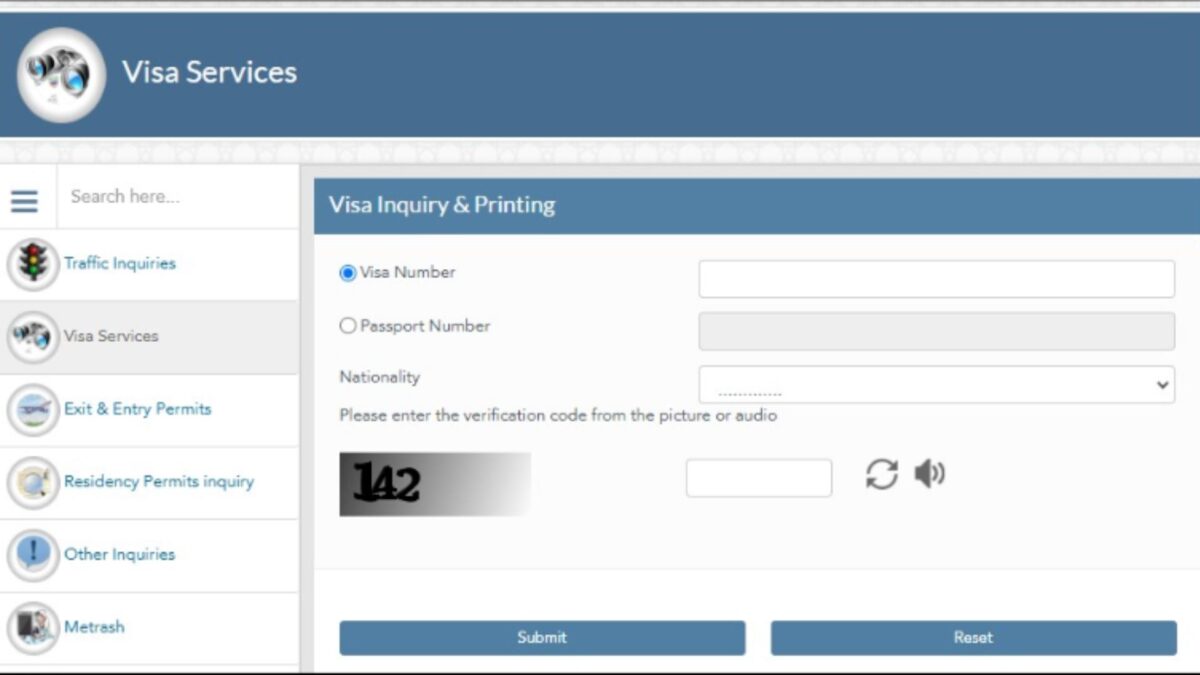

- Expatriate Employment

- Expatriates make up a significant portion of Oman’s workforce. Employers must obtain work permits and visas for expatriates, adhering to Omanization policies that prioritize hiring Omani nationals.

- Health and Safety

- Employers are responsible for maintaining a safe work environment and complying with health and safety standards.

- The law mandates insurance coverage for work-related injuries and diseases.

- Dispute Resolution

- Disputes between employers and employees are first referred to the Ministry of Labour for mediation. If unresolved, cases may proceed to the Labour Court.

Recent Amendments and Reforms

Oman’s Labour Law undergoes periodic revisions to align with international standards and evolving economic conditions. Key reforms include:

- Omanization Policy: Emphasizing the employment of Omani nationals in private sector roles.

- Flexible Work Arrangements: Introducing part-time and remote work options to accommodate diverse workforce needs.

- Enhanced Maternity and Parental Benefits: Strengthening family-oriented policies to support working parents.

Compliance Challenges and Best Practices

Challenges:

- Navigating Omanization quotas while maintaining operational efficiency.

- Ensuring compliance with documentation and procedural requirements for expatriates.

- Balancing wage structures to attract talent while adhering to legal standards.

Best Practices:

- Establish clear policies and procedures that reflect compliance with Labour Law.

- Maintain detailed employment records and contracts.

- Provide regular training on health and safety measures.

- Foster open communication to resolve disputes amicably.

Importance of Oman Labour Law in Shaping Workforce Dynamics

The Oman Labour Law strikes a balance between protecting employee rights and fostering an environment conducive to business growth. Its provisions ensure fair treatment, safety, and equitable benefits for workers while supporting employers in maintaining productive and harmonious workplaces.

Conclusion

Understanding and adhering to Oman Labour Law is essential for all employers and employees operating in the Sultanate. With its progressive reforms and commitment to workforce welfare, the law not only safeguards employee rights but also contributes to Oman’s economic development. Whether you’re an expatriate worker, a local employee, or an employer, staying informed about the latest developments in Labour Law is crucial for fostering compliance, productivity, and mutual respect in the workplace.